As we enter September, all the attention is on the upcoming meeting of the Federal Reserve (the Fed). Most experts expect that the Fed will reduce the Federal Funds Rate. This expectation is due to recent signs of cooling inflation and a slowdown in the job market. According to Mark Zandi, Chief Economist at Moody’s Analytics:

But what does this mean for the housing market, and more importantly, for you as a potential homebuyer or seller?

Why a Federal Funds Rate Cut Matters

The Federal Funds Rate has a significant influence on mortgage rates. Other factors such as the economy and geopolitical uncertainty also play a role.

When the Fed cuts the Federal Funds Rate, it sends a signal about the broader economy, and mortgage rates usually respond. While a single rate cut may not cause a significant drop in mortgage rates, it could contribute to the gradual decline that’s already occurring.

As Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), points out:

And any forthcoming Federal Funds Rate cut is likely to be part of a series of cuts. According to Lawrence Yun, Chief Economist at the National Association of Realtors (NAR):

The Projected Impact on Mortgage Rates

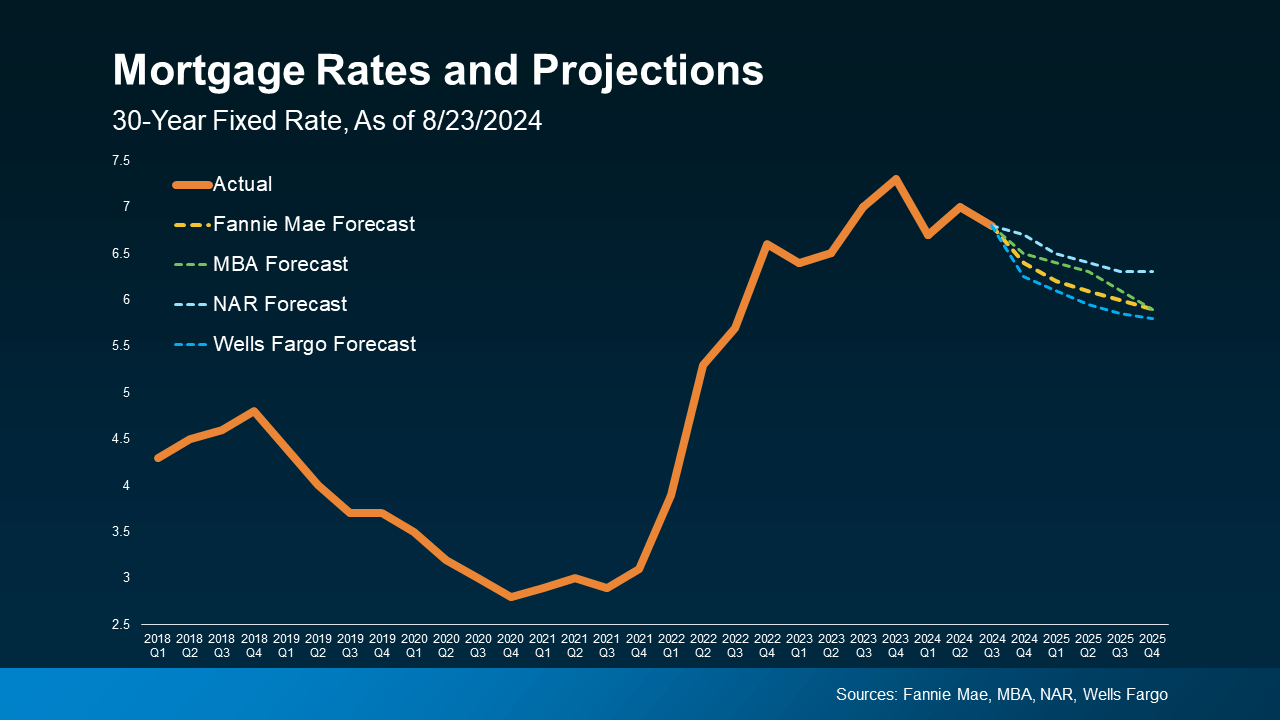

Industry experts have made projections for mortgage rates through 2025. One contributing factor to the expected gradual decline is the anticipated cuts from the Fed. The graph below shows the latest forecasts from Fannie Mae, MBA, NAR, and Wells Fargo (see graph below):

Recent improvements in inflation and signs of a cooling job market suggest that a Federal Funds Rate cut could lead to a moderate decline in mortgage rates (shown in the dotted lines). This is good news for both buyers and sellers for two big reasons:

Recent improvements in inflation and signs of a cooling job market suggest that a Federal Funds Rate cut could lead to a moderate decline in mortgage rates (shown in the dotted lines). This is good news for both buyers and sellers for two big reasons:

1. Alleviates the Lock-In Effect: Lower mortgage rates could help current homeowners ease the feeling of being stuck in their current home because today’s rates are higher than what they locked in when they bought their current house. If the fear of losing a low-rate mortgage has kept you out of the market, a slight reduction in rates could make selling a bit more attractive. However, this isn’t expected to bring a flood of sellers to the market, as many homeowners may still be cautious about giving up their existing mortgage rate.

2. Boosts Buyer Activity: Any drop in mortgage rates will make the housing market more attractive for potential homebuyers. Lower mortgage rates can reduce the overall cost of homeownership, making it more feasible for those who have been waiting to make a move.

What Should You Do? While a Federal Funds Rate cut is not expected to lead to drastically lower mortgage rates, it will likely contribute to the gradual decrease that’s already happening. And while the anticipated rate cut represents a positive shift for the future of the housing market, it’s important to consider your options right now. Jacob Channel, Senior Economist at LendingTree, sums it up well:

Bottom Line: The expected Federal Funds Rate cut, driven by improving inflation and slower job growth, is likely to have a positive, though gradual, impact on mortgage rates. This could help unlock opportunities for you. When you’re ready, let’s connect. That way, you’ll be prepared to take action when the time is right for you.